Toro Irrigation Solutions

Toro offers a range of innovative agriculture, turf and golf irrigation solutions to help deliver substantial benefits in yield, quality and water savings from the precise application of water and nutrients.

Find a dealerHelping growers and farmers

make the most of our precious resource.

From drip tape and tube, mini sprinklers, drip emitters, valves, filtration, we have the right irrigation solutions to help you increase productivity and maximise precious water resources.

View full rangeMost popular agriculture irrigation products

Helping landscapers and groundskeepers

maintain healthy and lush turf.

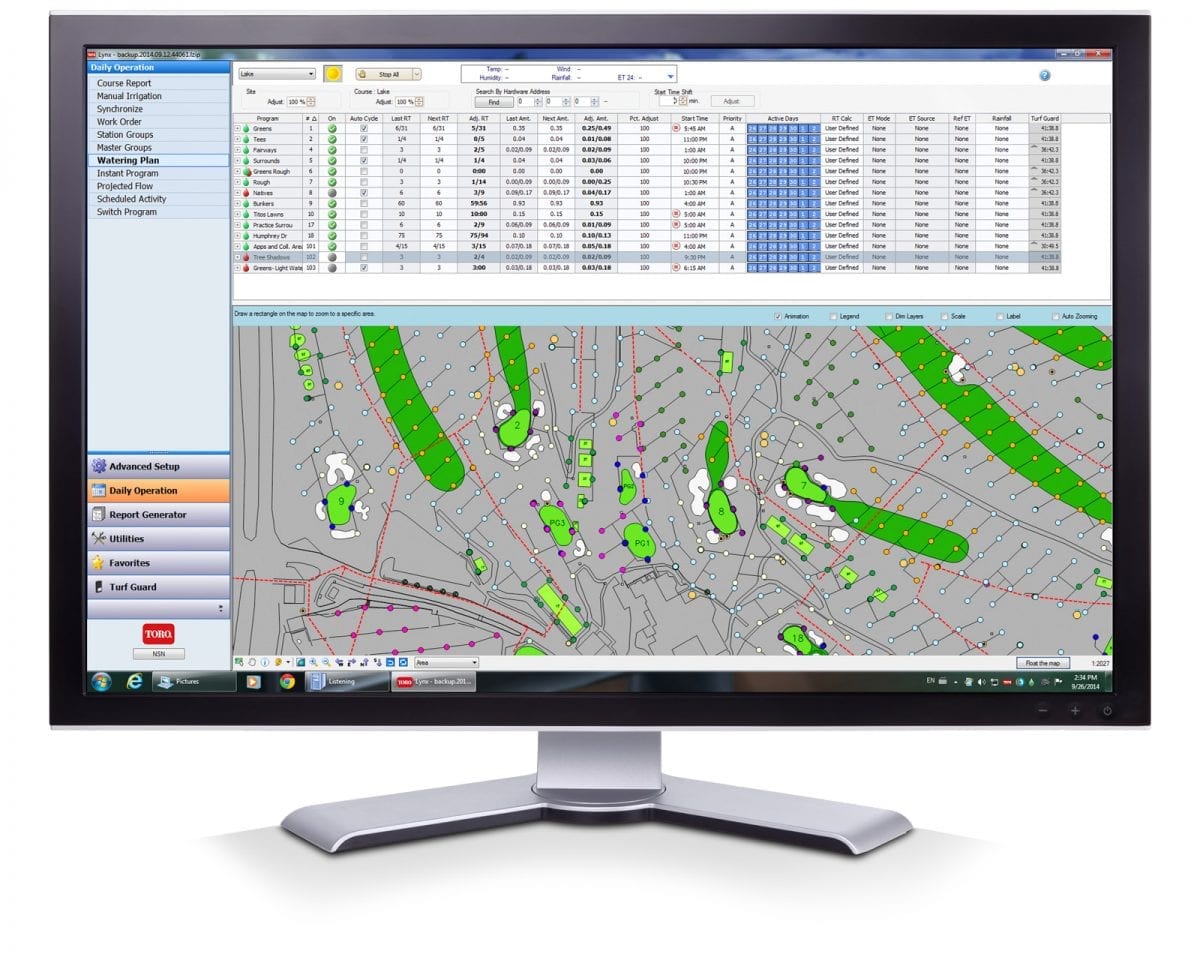

Specifically designed to help you address the unique challenges and changing priorities you face every day, you can have all your essential irrigation information readily available in a single intuitive interface with Toro Central Controls.

View full rangeMost popular turf irrigation products

Helping greenskeepers

manage world-class golf courses.

See why Toro has become the preferred brand in the majority of top golf courses both in Australia and world wide.

View full range